How Do You Calculate Stock Price After Reverse Split

Earnings per share are also now doubled. A reverse stock split increases the share price as the number of outstanding shares decreases.

Reverse Stock Split Meaning Example How It Works

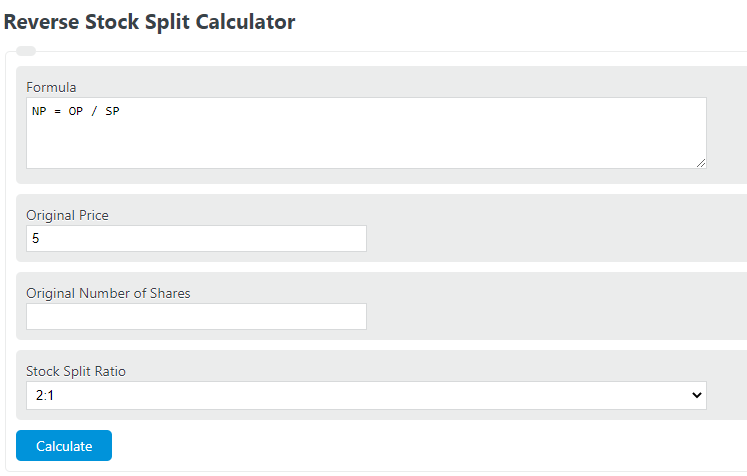

NP OP SP Where NP is the new price per share OP is the original price per share.

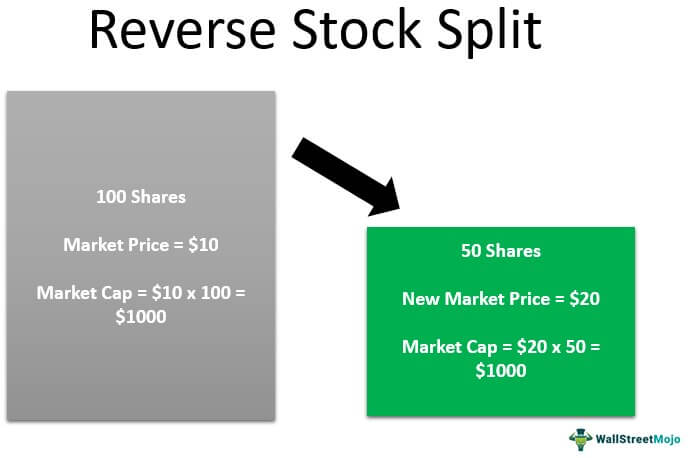

How do you calculate stock price after reverse split. Divide the number of outstanding shares by the multiple of the reverse stock split. If the 100 shares underwent a 13 reverse split you would have 33333 new shares. ABC Company owns 100000 shares outstanding and announces a 1001 reverse.

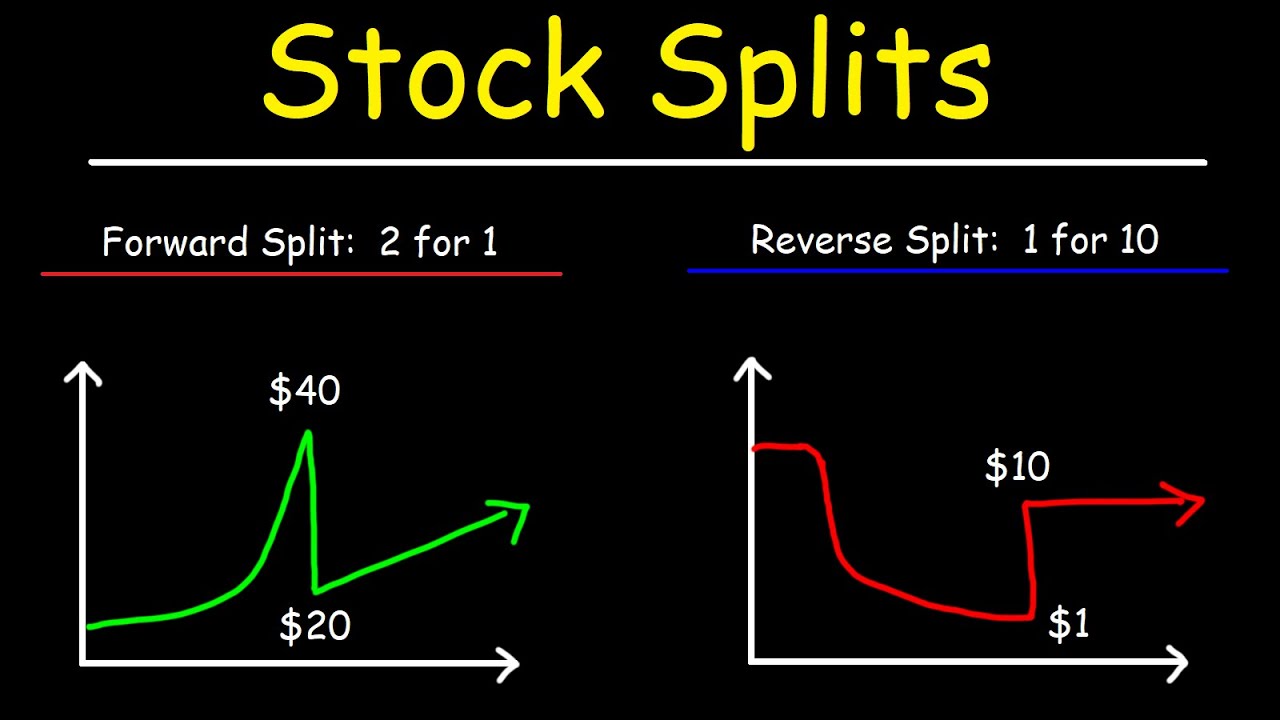

Adjustments for stock splits are similar but to calculate the factor you have to divide the number of shares after the split by the number of shares before the split. To adjust for a 2-for-1 split divide 1 by 2. If you owned 1000 shares 3 before the split you would own 100 shares 30 after the split.

In a 1-for-5 reverse stock split you would instead own 10 shares divide the number of your shares by five and the share price would increase to 50 per share multiply the share price by five. You now have 100 shares so your price per share is 600 ie 5 times the price you paid. 75 32 50.

In a forward split your cost per share is lower than before. The formula to calculate the new price per share is current stock price divided by the split ratio. Therefore when the number of shares is halved 21 reverse stock split the share price doubles to maintain the pre-reverse stock split market capitalization of 10000000.

If you owned two shares before the split the value of the shares is 75 x 2 150. It is often calculated in large ratios of 1 for 5 and 1 for 10 so a shareholder having 10000 shares before a reverse will hold 1000 new shares after a 1 for 10. In 2008 Jim Rosenfeld an associate professor of finance at Emory Universitys Goizueta Business School in Atlanta did a study involving 1600 companies that did reverse stock splits.

Stock price after the splitstock price BA Lets say for instance a company were to execute a 1 to 5 reverse stock split. The following formula is used to calculate the new price of a stock after a reverse stock split. Example of a Reverse Stock Split.

This formula works for both forward splits and reverse splits. Locate the net income for the period. Divide the total cost basis by the total number of shares you received in the reverse split including fractions.

In a reverse split your cost per share is higher. This determines the revised number of outstanding shares. You paid 60000 for your shares.

Divide the total cost basis of 1510 by 33333 to get a. Recalculate the outstanding shares of common stock after the reverse stock split. For example a stock currently trading at 75 per share splits 32.

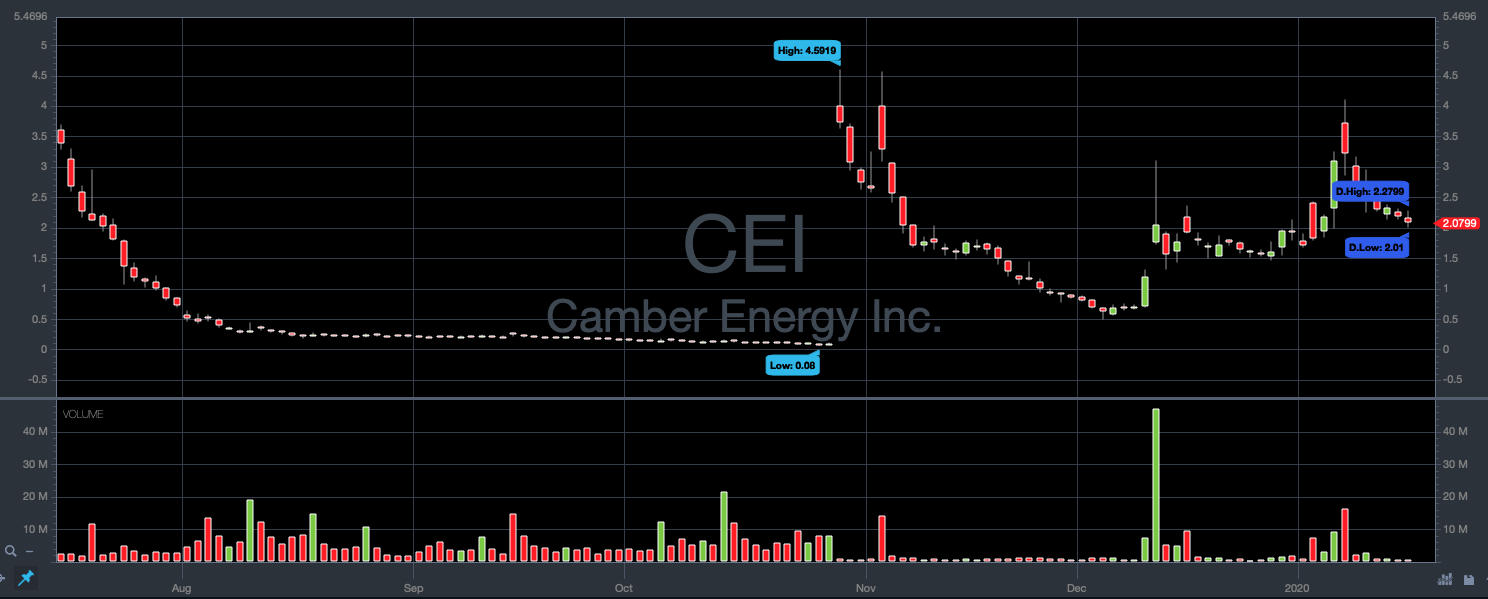

Another question here is why a 15 reverse split only increased the price to 40. Cathy is a new investor and currently holds 100 shares of ABC Company at 10 for a total value of 1000. You can then divide the number of shares you have by the second number in your exchange rate ratio.

To calculate a reverse stock split youll first need to total your stocks and find the exchange rate for the split. Youll want to check the value for correctness and watch for changes. Calculate the number of shares you have after the reverse stock split by dividing the number of shares you originally owned by the number of old shares that are.

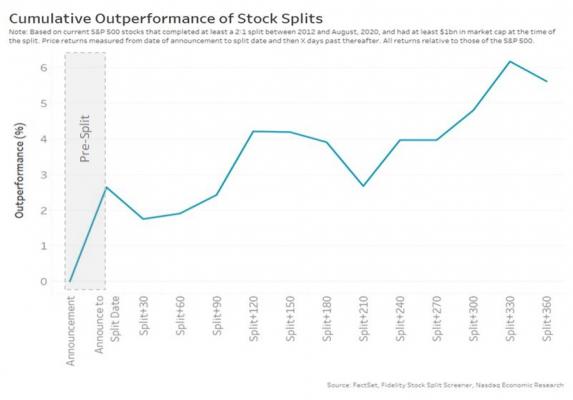

For example six months after a stock split the stocks in which analysts were bullish gained an average of 47 over the next six months with. A company may declare a reverse stock split in an effort to increase the trading price of its shares for example when it believes the trading price is too low to attract investors to purchase shares. What does a reverse split signal.

Divide the total cost of the position by the total number of shares in the position to find your cost per share. The factor is 05 Just like with dividend adjustments we multiply all historical prices prior to the split by 05. 5 times the 15 pre-split value is 75.

You received one additional share after the split but the price per share dropped to 50. During 2015 after the first week of a reverse stock split the results were mixed with an average drop of 6. Then the shareholders would receive 1 share for every 5 previously held shares they had prior to the split.

Your investment is still worth 200 but the stocks price is double what it was. With the exception of INVT the companies that saw a positive stock. If you owned 10000 shares of the company before the reverse stock split you will own a total of 1000 shares after the reverse stock split.

To calculate the new price per share. If Cute Dogs decides to do a 12 reverse split that means you will now own 50 shares trading at 4 each. So your total shares are worth 200 100 x 2 each.

This is your cost basis per share.

The Day Volkswagen Briefly Conquered The World Financial Times

The Comprehensive Guide To Stock Price Calculation Quandl Blog

Reverse Stock Split Meaning Example How It Works

Completing The Square Reverse Tabular Artifact Pdf Completing The Square Solving Quadratic Equations Algebra I

How Does A Stock Market Graph Adapt For A Stock Split Quora

If You Invested Right After Netflix S Ipo Nflx

1 Ranked Options Trading Podcast Option Alpha Podcasts Option Trading Option Trader

Reverse Stock Split What It Is What You Should Know Stockstotrade

What Happens In A Reverse Stock Split If You Don T Have Enough Shares Quora

Forward Stock Splits Vs Reverse Stock Splits Stock Trading 101 Youtube

Pin On Stock Market Tips Tricks

Apple Stock Split History Everything You Need To Know Ig En

The Comprehensive Guide To Stock Price Calculation Quandl Blog

Dividend Stocks Vs Reits For Safe Cash Flow Dividend Stocks Positive Cash Flow Cash Flow Statement

My Penny Stock List For 100 Returns Youtube In 2021 Penny Stock List Stock List Penny Stocks To Buy

Splitting Stocks Changes Them Fundamentally Nasdaq

What Happens To Options While Stock Is Doing Reverse Split Reinis Fischer

Reverse Stock Split What It Is What You Should Know Stockstotrade

Post a Comment for "How Do You Calculate Stock Price After Reverse Split"