How To Calculate Stock Warrants

The conversion ratio multiplied by the current stock price gives you the conversion value -- the total value of the shares youll receive if you exercise the warrant. Warrants are usually issued in conjunction with a bond or a preferred stock.

Unit Of Production Depreciation Budgeting Money Managing Your Money The Unit

For example if the conversion ratio to buy a stock is 51 this means the holder needs 5 warrants to purchase one share.

How to calculate stock warrants. Once issued warrants are negotiable securities traded on financial markets. The tools below are the ones I use to find tradable warrants and take advantage of. The advantage of call warrants is that it has unlimited upside similar to buying the underlying asset but the loss is limited to the amount initially invested in the call warrant.

Warrants have an expiration date when the right to exercise no longer exists. Your cost basis in the warrants is determined by allocating your cost basis in the original stock between the original stock and the new warrants based on the relative market values on the first day of separate trading. It can be traded through remisiers or via online trading which is similar to trading shares.

If the stock price is above the exercise price of the warrant then the warrants intrinsic value equals the difference between the two prices with an adjustment if the warrant isnt exercisable for shares of stock. First warrants have intrinsic value. Hello from Dudley Pierce Baker and Common Stock Warrants For our current subscribers and others interested in stock warrants I want to explain how we calculate and determine Our Current Rating on all of the stock warrants.

To exercise a warrant the holder pays the company the exercise price in exchange for a share of the companys stock. How to Calculate the Value of Stock Warrants. First warrants have intrinsic value.

If the stock price is above the exercise price of the warrant then the warrants intrinsic value equals the difference between the two prices with an. To calculate the value of the warrants youll first need the exercise price. The conversion ratio is the number of warrants that are needed to buy or sell one stock.

Stock warrants give you the right to buy shares in a company at a guaranteed price for a specified time although there is no obligation to exercise the warrants. The warrants are not current taxable income. Premium current price of the warrant - minimum value Minimum value exercise price - current price of the underlying stock Example of Warrant Premium In this example if the warrant.

But in order to trade warrants you must first be able to find them. Stock warrants offer investors a leveraged opportunity to profit if the underlying stock rises in value but each warrant has different terms that investors have to understand to calculate its. A warrant may convert into any whole or fractional number of shares.

First warrants have intrinsic value. Call Warrant is an alternative investment that investor can invest in Bursa Malaysia. Companies will often issue them to raise capital or as an employee benefits recruitment or retention package.

The difference between the strike price and the price of a share minus the cost. When you exercise warrants to buy the underlying stock you pay the stated strike price to the issuing company. Our Stock Warrants Ratings.

The expiry or expiration date. Warrants differ depending on which country you are in. A stock warrant is a type of derivative that gives the holder the right to buy a share of a company for a specific price within a set window of time or on a specific date.

Valuation of Warrants With Formula A warrant is a long-term security issued by a company which provides the holder with the right to buy a fixed number of companys ordinary shares at a fixed price during a specified period of time. While a stock warrant is in many respects similar to a stock option there are key differences in what they do. This gives the holder the potential opportunity to make a profit if the market price of the companys stock rises above the exercise price of the warrant.

If the stock price is above the exercise price of the warrant then the warrants intrinsic value equals the difference between the two prices with an. Typically warrant exercise prices are set well above the stocks market price at the time of issue. Trading stock warrants and more specifically warrant arbitrage provides a low risk opportunity for sustainable gains in the midst of market uncertainty.

Angel Investors Angel Investors Finance Investing Business Money

What Is Cagr And How It S Useful Finance Investing Business Finance Accounting And Finance

Stock Warrants What They Are How To Trade Them

Tax Shield Meaning Importance Calculation And More In 2021 Accounting And Finance Finance Investing Accounting Basics

Participants In The Securities Markets Bba Lectures Stock Market Stock Market Investing Intraday Trading

Payment In Kind Pik Loan Meaning Features Drawbacks And More Accounting Finance Budgeting Money Budgeting Finances

:max_bytes(150000):strip_icc()/dotdash_Final_Weighted_Average_of_Outstanding_Shares_Oct_2020-01-4f04f4b373de45dea110be8462c0bf58.jpg)

What Is The Weighted Average Of Outstanding Shares How Is It Calculated

Difference Between Lease And Finance Finance Accounting And Finance Finance Meaning

Understanding Equity Kicker In 2021 Equity Financial Management Business And Economics

/Wiener_Riesen_Rad_Ltd_1898-41accd5aa0f9438198764c26178b58cb.jpg)

I Own Some Stock Warrants How Do I Exercise Them

Factors That Influence Black Scholes Warrant Dilution

Common Stock Valuation Through Capitalization Technique Common Stock Capitalization Forex Candlestick Patterns

Natural Hedging Benefits Disadvantages And More Financial Life Hacks Accounting And Finance Financial Management

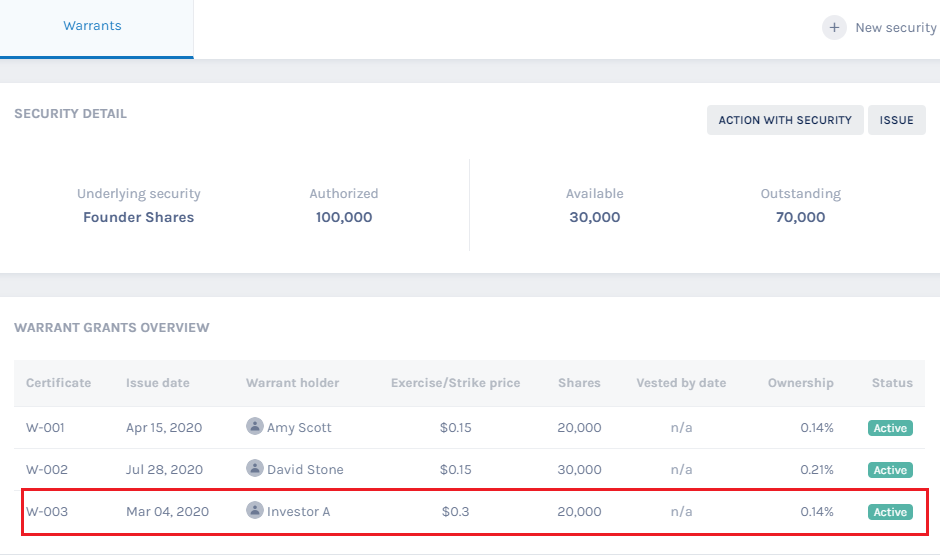

Exercising Stock Warrants Eqvista

Types Of Financial Statements Accounting Basics Accounting And Finance Business Money

Market Risk Premium Market Risk Investing Finance

Privately Held Company Vs Public Company Accounting Finance Money Management Budgeting Worksheets

Convertible Bonds Vs Warrants Meaning Differences Bbalectures Business Articles Bond Convertible

Free Online English Speaking Course In Hindi 30days13minutes English Vocabulary Words Online English Speaking Course Vocabulary Words

Post a Comment for "How To Calculate Stock Warrants"